PLTR Stock: Down 20%+ Today! Will Palantir stock recover?

Earlier today I posted a video about PLTR stock (LINK). Over the last 6 months PLTR stock is down over 70% and investors are wondering:

- What is going on?

- Will Palantir stock ever recover?

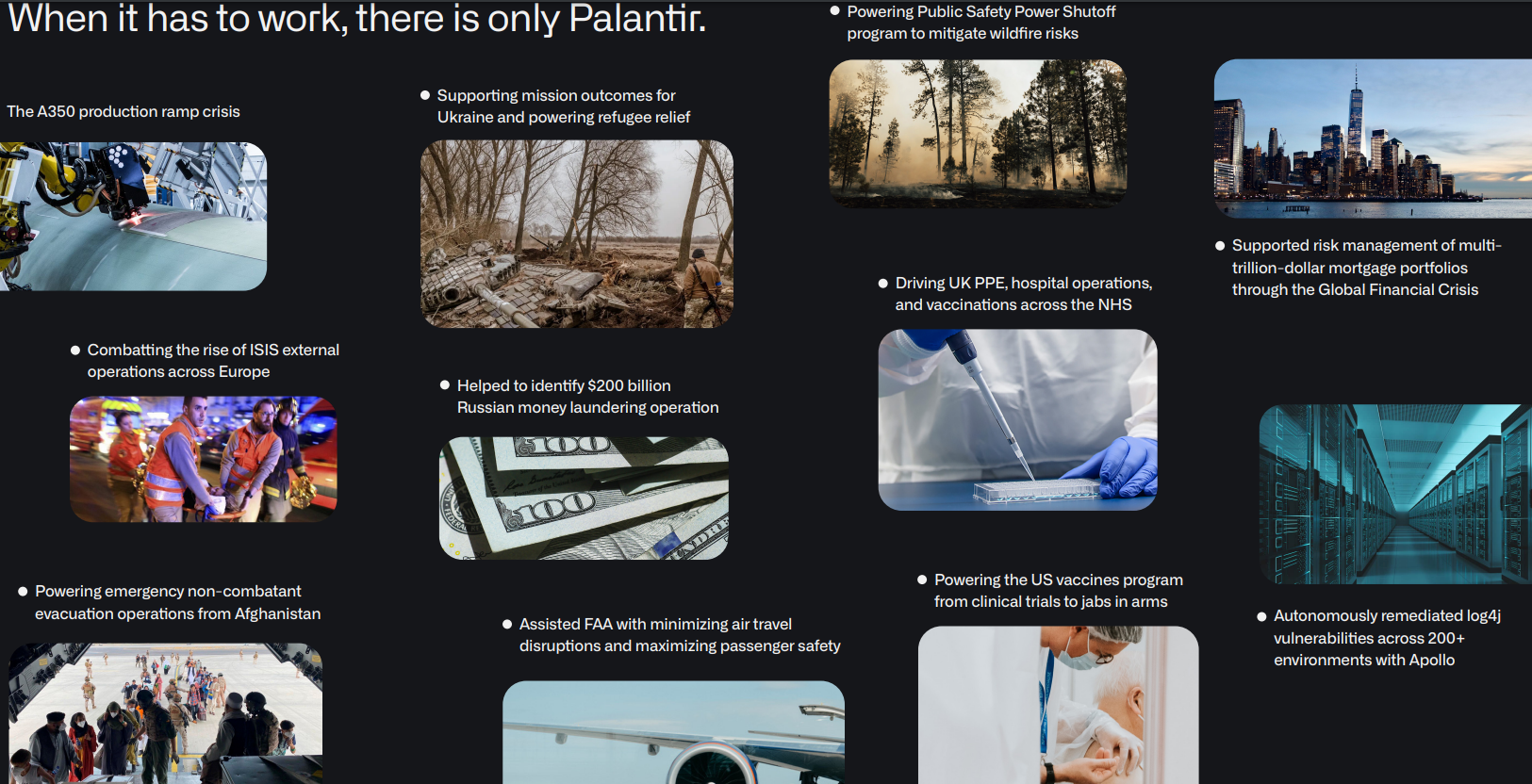

I've posted about Palantir several times as their core products (i.e. Gotham, Apollo, Foundry) appear to have a strong value proposition and they're rapidly taking market share. For example, during 1Q 2022 their commercial business grew by 54%! The global enterprise software market is NOT growing 50%, so this suggests that Palantir is rapidly taking market share.

Not only is Palantir successfully selling into new customers, but their existing customers are spending more with them. During the 1Q 2022 their net dollar retention was 124%. This means that even if Palantir didn't sign up any NEW customers during the quarter, their EXISTING customer base drove 24% revenue growth!

If Palantir is so successful, why is their stock getting crushed?

My concern...